California Construction News staff writer

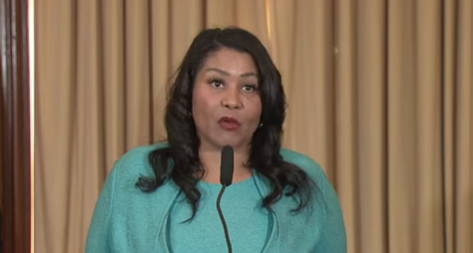

Mayor London N. Breed has proposed a ballot measure that she says will encourage investment in downtown by waiving the transfer tax on buildings that have converted from non-residential to residential use. The goal is to incentivize more underused office buildings to convert into housing, which would create a more sustainable downtown.

The Mayor will sign this measure onto the March 2024 ballot where it would need a simple majority to pass into law.

This proposal is part of a nine-strategy plan to facilitate new uses and flexibility in buildings. Legislation that became effective in August 2023 amends codes for zoning to accommodate the widest possible range of activities and uses and establish an adaptive reuse program to simplify the approval process and streamline requirements for converting underutilized office buildings into housing.

“We are working to do everything we can to support a more diverse and dynamic future for Downtown San Francisco,” Breed said in a statement. “By removing barriers to converting office to housing, we can take vacant space, turn them into homes, and bring more people into Downtown, which is good for our neighborhoods and our small businesses.”

The transfer tax — which is up to a 6 percent tax rate on transactions over $25 million – would be waived after a qualifying non-residential to residential conversion. The tax waiver would be limited to five million square feet of space converted and require that planning approval be complete by Dec. 31, 2029.

Projects would also have to get construction approval within three years of planning approval, to ensure conversions are moving forward. If not all of a building is converted, the transaction would be prorated by converted square footage. Transfer tax would still be due on non-converted space.

San Francisco is experiencing high office vacancy with over 30 million square feet (representing 34% of the office market) currently vacant. By allowing owners to creatively repurpose buildings into housing we can simultaneously reduce the office vacancy rate and spur significant new investment into Downtown, which will help stabilize and grow the local tax base.